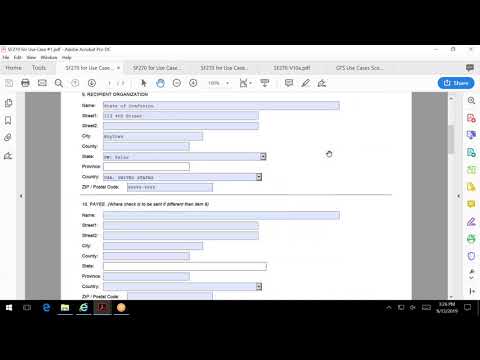

Hello and welcome to all of the 9-1-1 grantees. This video will explain how and when to use standard form 270 as part of the vouchering process for the 911. I'll be running through how to use the form and when. So, before we go right to the form, let's talk a little bit about the "when" in air quotes. The 9-1-1 grant program is a reimbursable grant program, and that means that rather than receiving all of the grant funds up front, you will be expected to submit vouchers for reimbursement as you incur expenses. The vouchering process will include two steps: submitting this standard form 270 via the Nitsa national 9-1-1 do t gov email address and submitting the necessary information via the 911 grants tracking system (GTS). The use of the grants tracking system has been covered by separate webinars, and we encourage you to take a look at the archived version if you have not had a chance. The grants tracking system will electronically be connected to your bank account, and once we approve your invoices, you will be electronically paid or the funds will be electronically transferred to your account. So, that's a really important thing to know. Request for reimbursement may be submitted as frequently as every month. For those of you that are state grantees and have sub-grantees, you are responsible for collecting and compiling all expenses invoices and vouchers from contractors and/or sub-grantees. So, your request for reimbursements should reflect the total expenses for each state grantee as you are submitting them. Let's take a look at the form. As you can see, the name of this form is "Request for Advance or Reimbursement", and while the form can be used for both purposes, the 9-1-1 grant program will use it only for reimbursement. That's...

Award-winning PDF software

2019 730 Form: What You Should Know

SUTTON REQUESTS FORM 730. REFERRING FIRM NAME AND AGENT TO US. Aug 27, 2025 — This revised form replaces this form. 730EZ-PROCEEDS-A-RESIDENT-SUB-PAY.pdf Form 730-TIMETABLE-2017.2017. A 10 per month fee on initial payment for a one- time payment of 100.00 is due on the 14th date of the month commencing in October 2017. You should use Form 730TIMETABLE-2017 as the reference file to ensure timely filing. This is for payments under the Temporary Protected Status (TPS) and/or the Asylum Act. Form 720-Visa-Certification-W-P.2018. A 10 per month fee on initial payment for a one- time payment of 100.00 is due on the 14th date of the month commencing in May 2018. You should use Form 720-VISA-Certification-W-P for all payments under a Visa Waiver Program under the Immigration and Nationality Act (INA). Form 780-Certification of Earned Income. A 15 per month fee on initial payment for a one- time payment of 100.00 is due on the 14th date of the month commencing in September 2018. You should use Form 780-Certification of Earned Income for all payments under the Earned Income Tax Credit, the Family Earnings Tax Credit or under the Health Coverage Tax Credit. You must pay the 15 fee if you have one or more qualifying children below the age of 17. Form 890-A Tax Return, Statement of Earnings. A one-time payment of 300.00 on the 4th month of the tax year will be due on the 14th of the following month. If you are an individual taxpayer making a regular tax return, you may use Form 890-A instead of Form 886. See Form 890-A. This form is no longer provided. Form 886-Annual Return. A one-time payment of 300.00 on the 4th month of the tax year will be due on the 28th of the following month. If you are an individual taxpayer making a regular tax return, you may use Form 886 instead of Form 890. See Form 886-Annual Return.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 730, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 730 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 730 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 730 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 Form 730