Content: Music, okay. So let's talk about the W-4. Okay, in the upper left-hand corner, I have highlighted in yellow what the IRS gives you permission to do with your W-4. It states that you should consider completing a new form W-4 each year and when your personal or financial situation changes. Well, what personal or financial changes will require you to adjust your W-4? Some examples include having children, getting married or divorced, or starting a business. The IRS advises that every year, you should review your W-4 to see if any adjustments are needed. Many people haven't changed or looked at their W-4 since they started their job and may not realize they could potentially claim more allowances if they fill out the form correctly. Another important note is about the status of head of household, which is highlighted in yellow. Only someone who is not married and is paying more than 50% of the cost for anyone living in their home can claim this status. If you are paying over 50% of your living expenses for yourself, your children, or a dependent such as a parent or grandparent, you can claim head of household. However, if you are married, even if you earn more than your spouse, you cannot claim head of household. This status is reserved for single individuals. Now, let's go through the personal allowance worksheet, which is on page 1. It should be pretty self-explanatory. Just read each line carefully. Starting with line 8, if no one else can claim you as a dependent, enter 1 for yourself. For line B, enter 1 if you're single and have only one job. If you are married and both you and your spouse have a job, enter the appropriate number for line B. Line C is where...

Award-winning PDF software

I 730 Form: What You Should Know

The person who made this petition must have been immigrated to the U.S. before November 2002. Form I-730, Refugee / Ashlee Relative Petition — USCIS Aug 31, 2025 — Form I-730 — Application for Travel Document, Requirements and Forms, can be filed by people who are: asylum beneficiaries; refugees in the U.S. (for whom the petition is required); and asleep. If the beneficiary is the holder of either provisional or UAB status, the petition is also necessary for a child of the immigrant and a sibling or parent of the beneficiary; or, if the holder of UAB status or the spouse or child of a refugee, the petition is also necessary for a child of the refugee and siblings; or, sibling or parent of their spouse. If the beneficiary is a U.S. national who is a nonresident alien and is not a refugee, the petition is also necessary for the adopted, foster, or foster child of the dependent. Form I-730, Refugee/Ashlee Relative Petition — USCIS Sep 12, 2025 — USCIS will post a new Immigration Tip sheet for refugees and asylum seekers from the List of Frequently Asked Questions (FAQs) and the guidance document on refugees and asylum seekers — Refugees and Asylum Petition — USCIS Sep 19, 2025 — USCIS will post a new Immigration Tip sheet for refugees and asylum seekers from the I-730 and Form I-730 Frequently Asked Questions — USCIS. This new tip sheet highlights some common questions refugees and asylum-seekers have about I-730, Form I-730, and how a refugee or asylum seeker petition can be filed in the U.S. as an I-130 dependent relative or Form I-730 in a refugee relative petition application. Refugees and, refugee dependents who are filing a petition as an I-130 dependent relative must sign an I-330 or Form I-485 (or OMB-OIS-290). Non-immigrants also may petition for a spouse, child, siblings (including a spouse from a country to which their spouse is a national), or parents of a refugee or an asylum-seeker of their own.

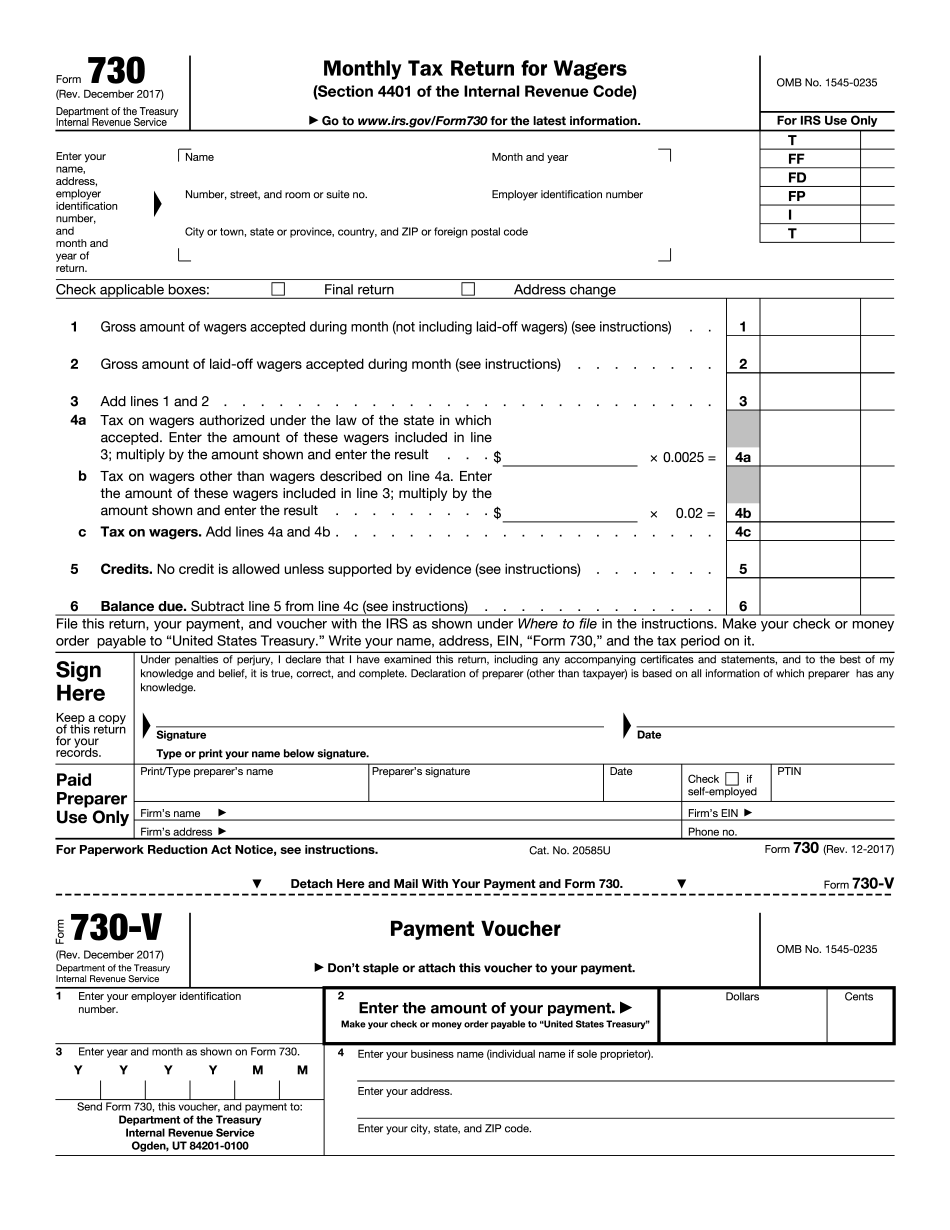

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 730, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 730 Online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 730 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 730 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing I 730 form