Award-winning PDF software

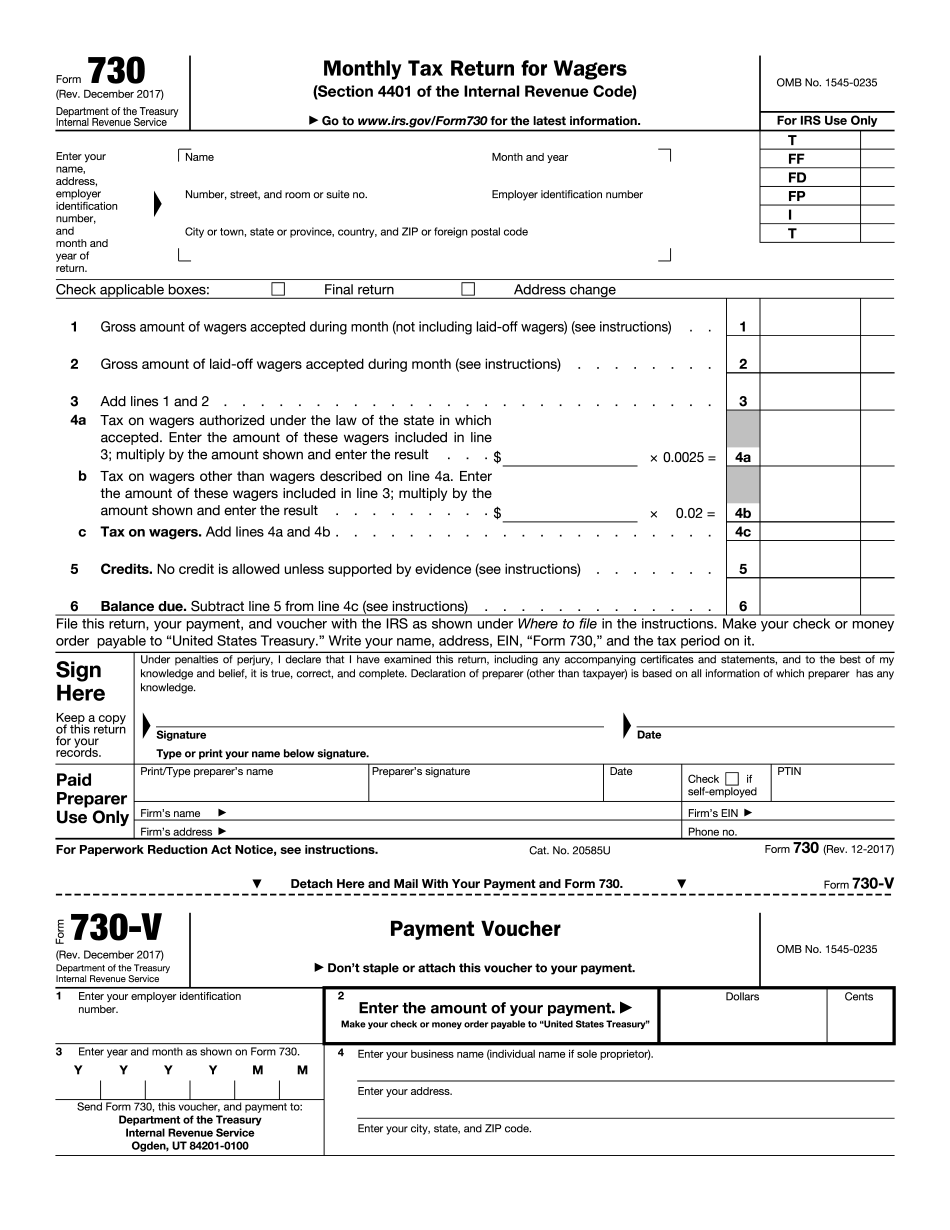

Feeling Lucky? Take A Gamble On Irs Forms 11-C And 730: What You Should Know

You may be taxed if you win big on a blackjack game, roulette, or poker. Be sure you comply with all requirements under the laws of your state. The “federal” tax rate is 35 percent. However, because the IRS will withhold 2 percent of your winnings from your Social Security wages, you also must report to the IRS on IRS Form W-2. You must provide information about your tax withholding from your Social Security card, and what you pay in federal income taxes for each year (2017) the money is held. Topic No. 440 Exempt Organizations and the Form 990 This topic explains the general rules for filing the Form 990 and the annual filing requirements for certain groups of charities, as well as the rules for tax-exempt status for charities whose principal purpose is activities other than to educate people about the importance of avoiding tax liabilities. If the activities of a nonprofit organization, such as a social club, include gambling or betting on sports or other contests, the organization may be a tax-exempt entity. Topic No. 522 The Gambling Income Deduction If you have taxable income and gambling income, you can take the gambling deduction on Schedule A. Topic No. 536 Charitable Gaming (Nonprofits) Generally, charities, or nonprofit organizations in the United States, that play games of chance are considered taxable increment income. The activity or conduct of a nonprofit organization is taxable if the organization has any gambling activity which it engages in on its own behalf or at the direction of, or with the approval of, any governmental authority. The activity or conduct of all taxable nonprofit organizations, if not exempt, is subject to the general gambling income rules of Sec. 199A and Sec. 199D of the Internal Revenue Code Income from a game of chance involving property not taxable To qualify under Sec. 199A, you must have an income from the activity or conduct of any taxable tax-exempt organization other than a private foundation. You cannot qualify if you make your. Income from gambling only. For more information on what qualifies your activities for deduction under Sec. 199A, click here.

Online options assist you to to organize your document administration and enhance the efficiency of your respective workflow. Stick to the quick manual as a way to comprehensive Feeling lucky? Take a gamble on IRS Forms 11-C and 730, keep clear of problems and furnish it in a very well timed fashion:

How to complete a Feeling lucky? Take a gamble on IRS Forms 11-C and 730 on the net:

- On the web site aided by the type, click Start off Now and pass for the editor.

- Use the clues to fill out the pertinent fields.

- Include your own facts and make contact with information.

- Make sure which you enter suitable data and quantities in ideal fields.

- Carefully check the articles of the type at the same time as grammar and spelling.

- Refer to help section in case you have any questions or address our Aid team.

- Put an electronic signature on the Feeling lucky? Take a gamble on IRS Forms 11-C and 730 aided by the aid of Indicator Resource.

- Once the shape is done, push Executed.

- Distribute the all set form via electronic mail or fax, print it out or preserve on the unit.

PDF editor helps you to make improvements in your Feeling lucky? Take a gamble on IRS Forms 11-C and 730 from any internet linked equipment, customise it in line with your requirements, sign it electronically and distribute in several ways.