Award-winning PDF software

Form 730 California San Bernardino: What You Should Know

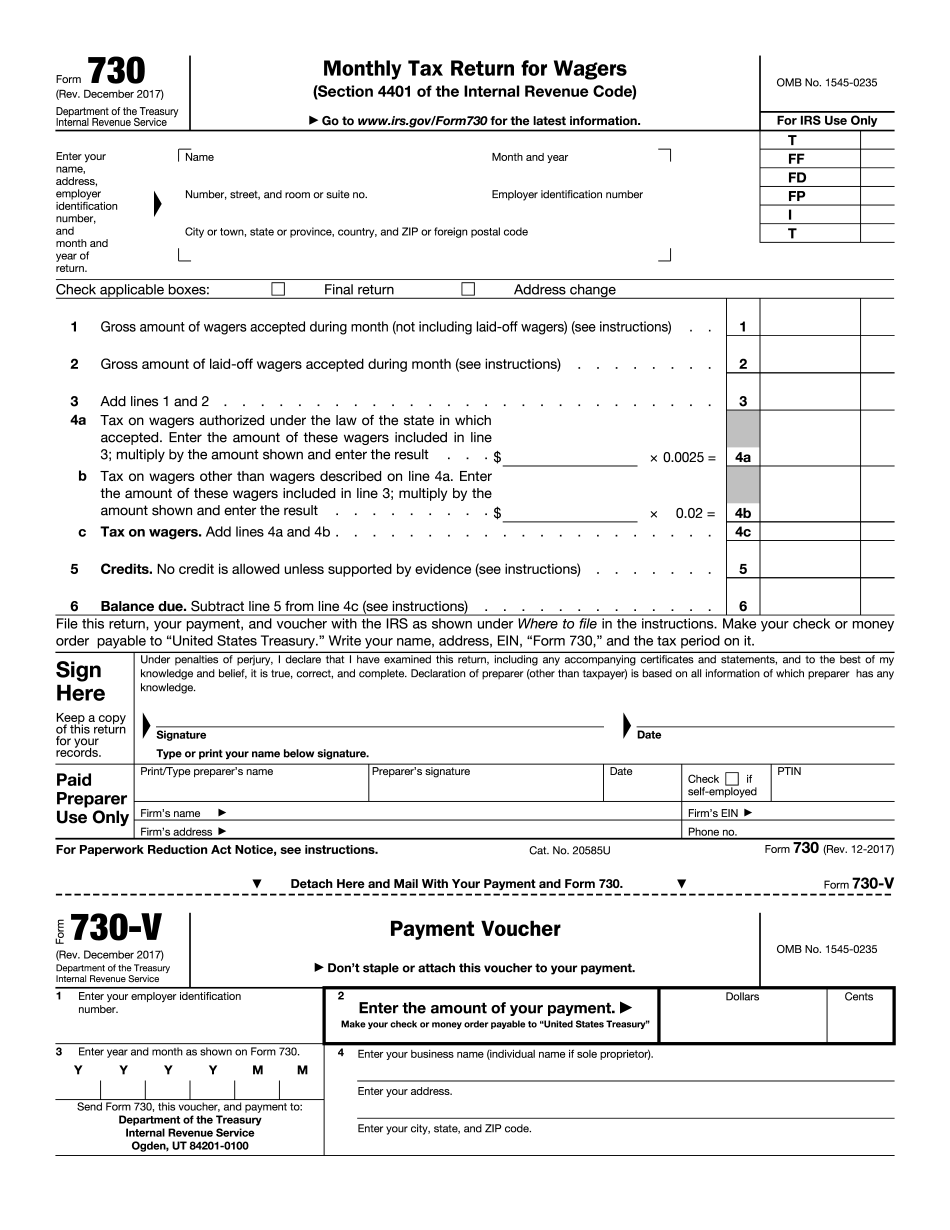

Mar 27, 2025 — Filing Procedures for Individuals with Individual Income Tax Liabilities. A 730 evaluation may be made, however, for a variety of reasons including a change in marital status, divorce, legal separation, child custody and visitation, changes in support orders, legal separation or divorce, and changes in alimony and child support orders. Form 730 may be requested by either spouse or non-party when there is no longer a valid marriage. The Evaluation must be made by an authorized service entity, the same entity which will review your tax return. It is important that an evaluator make a determination regarding the current status of the marriage or civil union. The Evaluation can take up to 30 days, from the date that you first file. Each Evaluation is 100. Form 730 may be requested as a “Wager Evaluation” for a spouse, or a “Service Evaluation” for a non-party by: “Wager Evaluation” — Any individual may request a 730 Evaluation at any time. This service entity, the Department of Consumer Affairs' Department of Consumer Affairs, is authorized to make Wager Evaluations for spouses or non-parties by: Appointed service claim: For joint claims under any court order in effect at the time you request an evaluation. If “Joint with a party” appears at the end of the name of one person and “Non-joint” at the end of the name of another, the evaluation is for the spouse of the person whose name first appears at the end of the name at the end of the claim. Appointed defense claim: For any claim under any court order in effect at the time you request an evaluation, except court-ordered support which must be submitted for evaluation. If “Joint with a party” appears at the end of the name of one person and “Non-joint” at the end of the name of another, the evaluation for the spouse of the person whose name first appears at the end of the name at the end of the claim is for the service claim; where the spouse of the claiming spouse is under the age of 18 at the time the claim is filed, the evaluation is for the claiming spouse. Appointed service claim and defense claim for joint income. A service claim and defense claim for jointly held income for which an appraisal form has been used is considered an “appraised value” for purposes of the 730 evaluation.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 730 California San Bernardino, keep away from glitches and furnish it inside a timely method:

How to complete a Form 730 California San Bernardino?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 730 California San Bernardino aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 730 California San Bernardino from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.