Award-winning PDF software

Form 730 Texas Dallas: What You Should Know

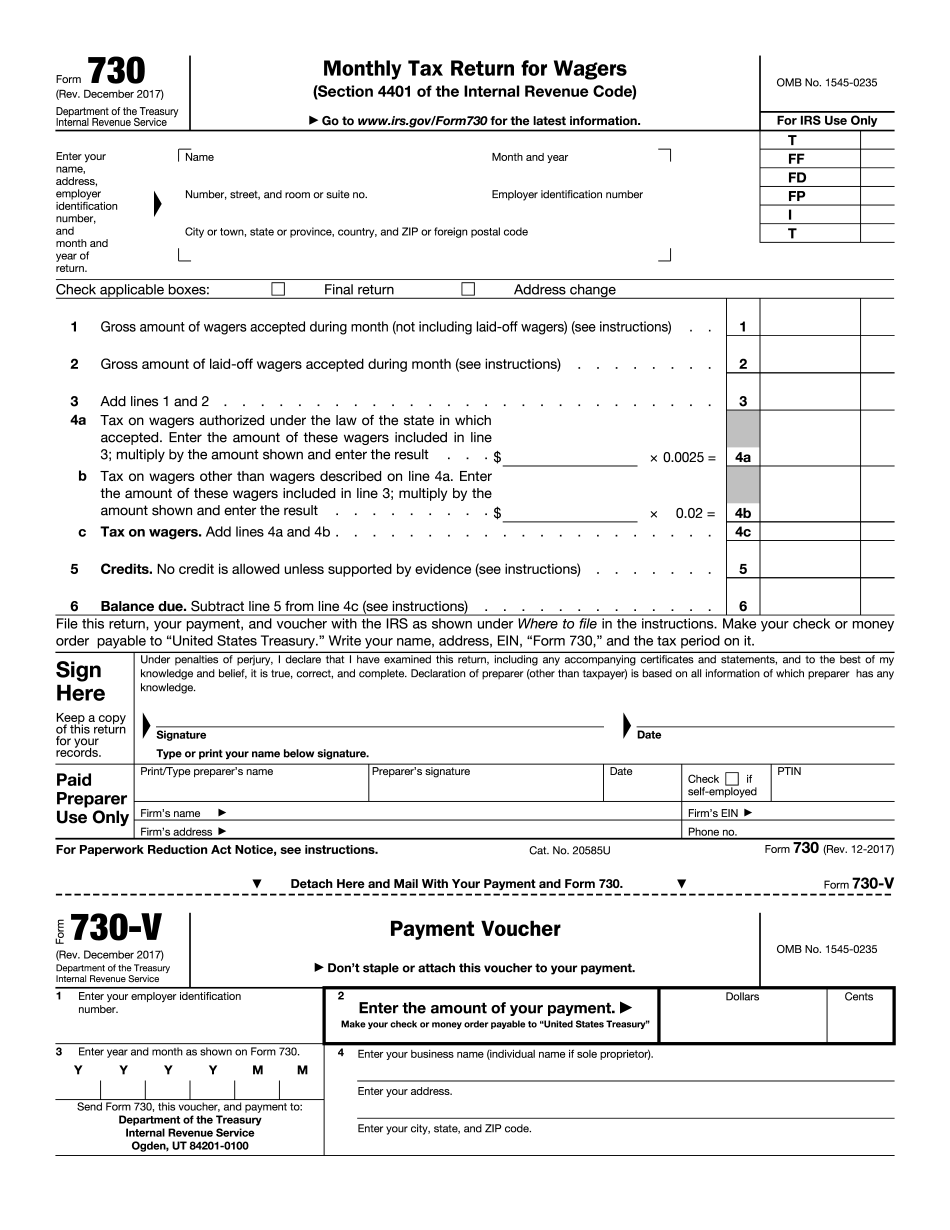

Return for Wagers (Excise Tax). The information and filing requirements appear below. The tax is due on or before December 31, depending on your filing status. You must report your taxable wagers (including the total amount you won) by March 31, 2018. Any wagers you have received and not paid by December 31, 2016, or earlier, should be reported on tax return form 730X. To calculate the amount to report, multiply the total amounts won by tax rate. If you win more than twice the amount you win during the year, don't have to report the additional amount. Only the total amount, not the amount you win, which is the amount to report by March 31, 2017, must be reported by this time. If you win more than twice the amount you win during the year, you have to report the additional amount by December 31. The tax should be paid with an official, certified check or money order signed by the payee. Form 730X is available from your local county assessor's office; telephone your assessor early and often for updated information. A copy of Form 730X are available with your tax return on demand for a fee of 10% of the filing fee, plus a 10.00 handling charge, to the same address listed above, within 3 weeks after the close of the tax year. You are prohibited from using other methods for reporting wagers including credit card information, telephone calls, and mail. If you win a large amount of money, be aware that your total net wager earnings are reported to the tax collector after the taxes are paid. If those total income taxes are 2.00 or more, this is considered income and subject to all federal income taxes. The IRS can assess a tax penalty, known as Back-to-Back, on net losses of 50,000 or above. If you are the winner and lose both times, it is considered double jeopardy. You must pay a penalty and back taxes after the first violation. A back-to-back violation also causes a penalty of 2% of the total loss in excess of 50,000. If you lose both times in one year, the penalty is calculated on the first violation and the total income tax is applied to the amount of the second violation. This would be your Back-to-Back penalty multiplied by the difference between the first and second violations.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 730 Texas Dallas, keep away from glitches and furnish it inside a timely method:

How to complete a Form 730 Texas Dallas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 730 Texas Dallas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 730 Texas Dallas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.