Award-winning PDF software

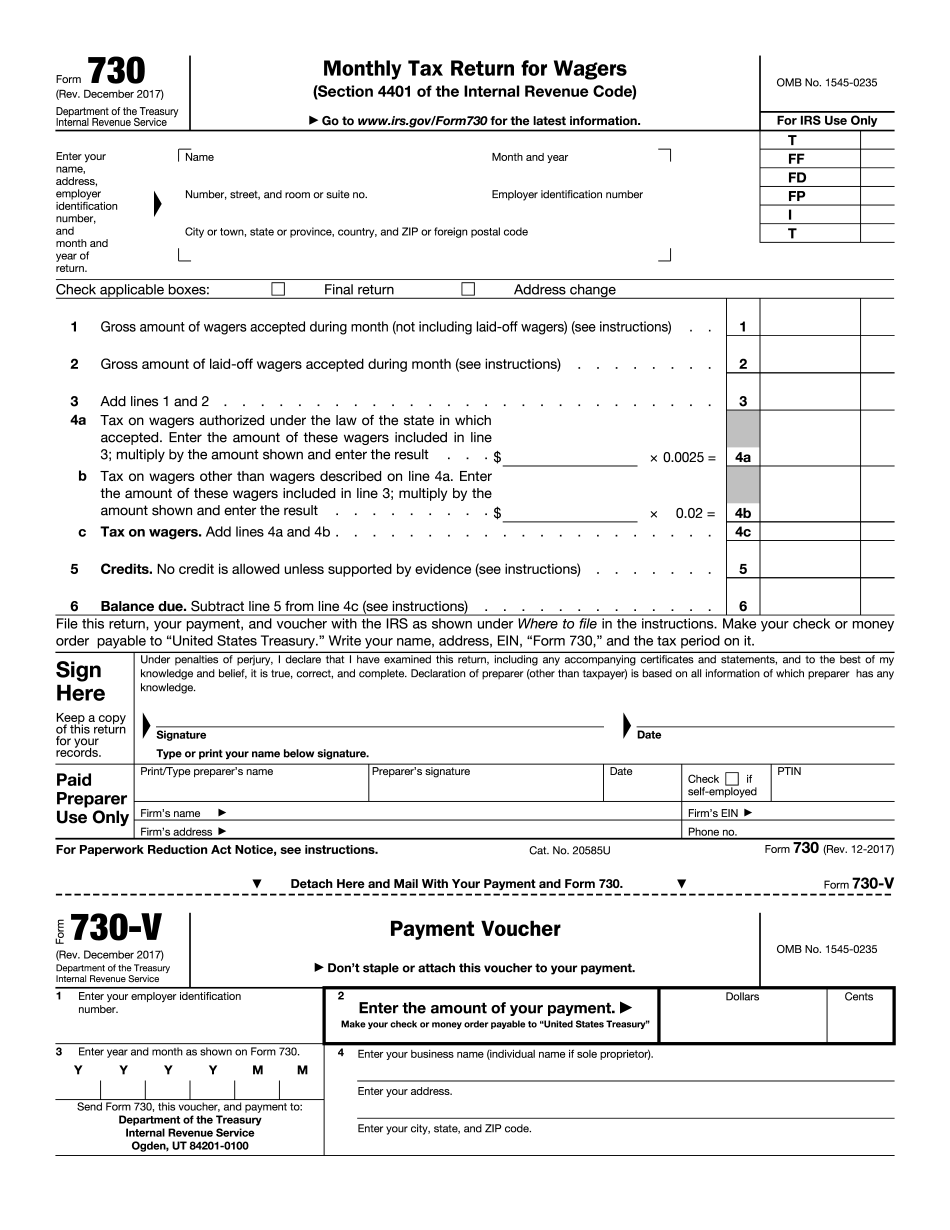

Form 730 Renton Washington: What You Should Know

Utility Taxes — City of Renton There are two tax types in WA. One is the Utility Tax, that is for the utility companies to recover their expenses that they need to cover for your utilities. The other is the Business and Occupation Tax. The Utility Tax is for utilities that they provide to you. The Business and Occupation Tax is for Businesses that your household member owns, rents or uses. The Utility Tax is paid on the Utility Company's bills if you are the customer. That is whether you pay for a utility with a credit card, a check or cash. The Business and Occupation tax can also be paid by withholding or by credit card. The Utility Tax is 2.80/month & 1.45/mile. In WA the Business and Occupation Tax is paid in monthly installments. The tax is due each April 1, June 1, September 1, December 1, March 1, July 1, and November 1. To pay your Utility Tax just enter the amount due online. You cannot pay it at a bank or credit union. To register for the online Utility Tax payment please visit myRentonPA.com or call to make an appointment. If you have been a customer of the Utility Company in the past 60 days & you have a current Utility Bill, you may renew online. Business Taxes — City of Renton To register for the Business Tax in the City of Renton click here: myRentonPA.com or call us at, and we'll help you register. Utility Tax — City of Renton To register for the Utility Tax click here: myRentonPA.com You must register & pay your Utility Tax using the online filing system at myRentonPA.com or call me. To make an appointment call us at the phone number above. You may need to contact an auditor that administers the Utility Tax to get your Utility Tax amount. The City Auditor's Office is located at 50 NE 25th Street, Renton, WA 98057. Utility & Business Taxes — City of Renton If your Utility & Business Tax is 100.00 or more you will have to pay quarterly, not monthly. (It's not a 30.00 fee. No, it's only a 4.50 per quarter.) You have until April 10th to pay.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 730 Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form 730 Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 730 Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 730 Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.